Table Of Content

Though the central bank doesn’t directly set the rates for mortgages, a high federal funds rate makes borrowing more expensive, including for home loans. If borrowers do not repay unsecured loans, lenders may hire a collection agency. Collection agencies are companies that recover funds for past due payments or accounts in default. The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. Based on the details provided in the amortization calculator above, over 30 years you’ll pay $351,086 in principal and interest. With a longer amortization period, your monthly payment will be lower, since there’s more time to repay.

Home equity loan

The total is divided by 12 months and applied to each monthly mortgage payment. If you know the specific amount of taxes, add as an annual total. When picking a mortgage, consider the loan term, or payment schedule. The most common mortgage terms are 15 and 30 years, although 10-, 20- and 40-year mortgages also exist. You’ll also need to choose between a fixed-rate mortgage, where the interest rate is set for the duration of the loan, and an adjustable-rate mortgage. Fixed-rate mortgages offer more stability and are a better option if you plan to live in a home in the long term, but adjustable-rate mortgages may offer lower interest rates upfront.

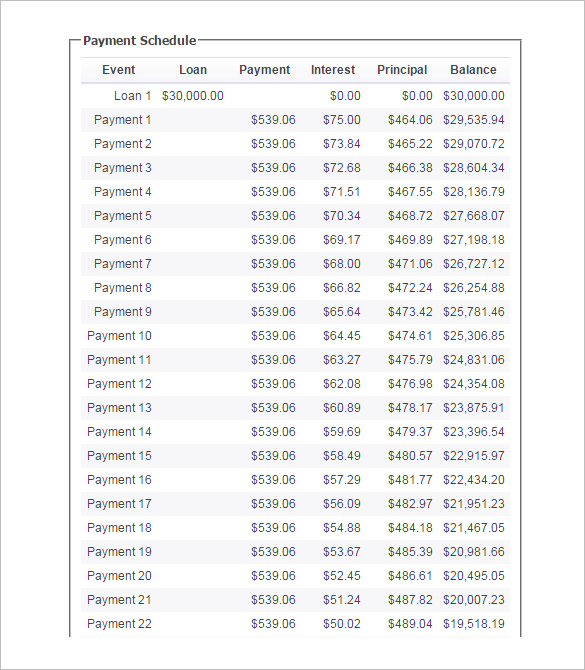

Amortization schedule

Over the course of the loan, you’ll start to see a higher percentage of the payment going towards the principal and a lower percentage of the payment going towards interest. Getting the best interest rate that you can will significantly decrease the amount you pay each month, as well as the total amount of interest you pay over the life of the loan. They can be either fixed, staying the same for the mortgage term or variable, fluctuating with a reference interest rate. A lump-sum payment is when you make a one-time payment toward your mortgage, in addition to your regular payments. How much of a lump sum payment you can make without penalty depends on the original mortgage principal amount.

How to Negotiate Mortgage Rates

Many mortgage lenders generally expect a 20% down payment for a conventional loan with no private mortgage insurance (PMI). The amount of cash a borrower pays upfront to buy a home; it goes toward the purchase price with mortgage loans typically used to finance the remaining amount. To decide if you can afford a house payment, you should analyze your budget.

Most lenders are required to max DTI ratios at 43%, not including government-backed loan programs. But if you know you can afford it and want a higher debt load, some loan programs — known as nonqualifying or “non-QM” loans — allow higher DTI ratios. Interest is the fee you pay to your mortgage company to borrow the money. The interest you pay is based on a percentage of the remaining loan amount. When you get a mortgage, the lender pays for the cost of the home upfront.

New Jersey Mortgage Calculator - The Motley Fool

New Jersey Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

Reducing monthly mortgage payments

After you’ve input this information, you can see how your payments will change over the length of the loan. You can use this information to find out how making extra payments will affect how soon you pay off your loan. An amount paid to the lender, typically at closing, in order to lower the interest rate. Also known as “mortgage points” or “discount points.” One point equals 1% of the loan amount (for example, 2 points on a $100,000 mortgage would equal $2,000). A mortgage term is the length of time you have to repay your mortgage loan.

Mortgage Interest Rate

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate.

How to calculate mortgage payments

A homeowners insurance premium is the cost you pay to carry homeowners insurance – a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Mortgages Move Up for Homeseekers: Mortgage Interest Rates Today for April 29, 2024

If you’re ready to take the next steps toward becoming a homeowner, be sure to start the approval process with Rocket Mortgage. You can apply online or speak to a Home Loan Expert to get a better idea of how much you’ll pay after you close. The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan.

Mortgage refinance is the process of replacing your current mortgage with a new loan. Often people do this to get better borrowing terms like lower interest rates. Refinancing requires a new loan application with your existing lender or a new one. Your lender will then re-evaluate your credit history and financial situation.

For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because you’re paying the loan off in a compressed amount of time. This calculator doesn’t include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose. Your estimated annual property tax is based on the home purchase price.

Extra payments on a mortgage can be applied to the principal to reduce the amount of interest and shorten the amortization. To calculate amortization with an extra payment, simply add the extra payment to the principal payment for the month that the extra payment was made. Any additional extra payments throughout the loan term should be applied in the same way.

Homeowners insurance also provides liability insurance if there are accidents in your home or on the property. Interest rates are increasing due to monetary policy intervention responding to high inflation rates. The higher interest rates reduce aggregate demand as fewer consumers take a loan, which eventually can lead to disinflation and lower inflation expectations. When working with the calculator, please remember the dollar amounts displayed aren’t guaranteed, and what you actually pay may be different. The estimates you receive are for illustrative and educational purposes only.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay — $514,715 in total. Each month we’ll pay $2,859.53, over 60% more than with the 30-year loan. When all’s said and done, for a 30-year loan at 3.5% interest, we’ll pay $1,796.18 each month. In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond's value at maturity, a bond's market price can still vary during its lifetime. Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Amortization isn’t just used for mortgages — personal loans and auto loans are other common amortizing loans.

No comments:

Post a Comment