Table Of Content

The downside is that you’ll spend more on interest and will need more time to reduce the principal balance, so you will build equity in your home more slowly. Using the above calculator can help you put together all of these complex variables to get a clear picture of your monthly mortgage payment so you know exactly how much to expect. Using a mortgage calculator will give you a rough estimate of what you can expect to pay for homes in different locations at different price points.

Terms explained

If you want the payment estimate to include taxes and insurance, you can input that information yourself or we’ll estimate the costs based on the state the home is located in. Then, click “Calculate” to see what your monthly payment will look like based on the numbers you provided. Lock in low rates currently available and save for years to come! If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes.

How a Larger Down Payment Impacts Mortgage Payments*

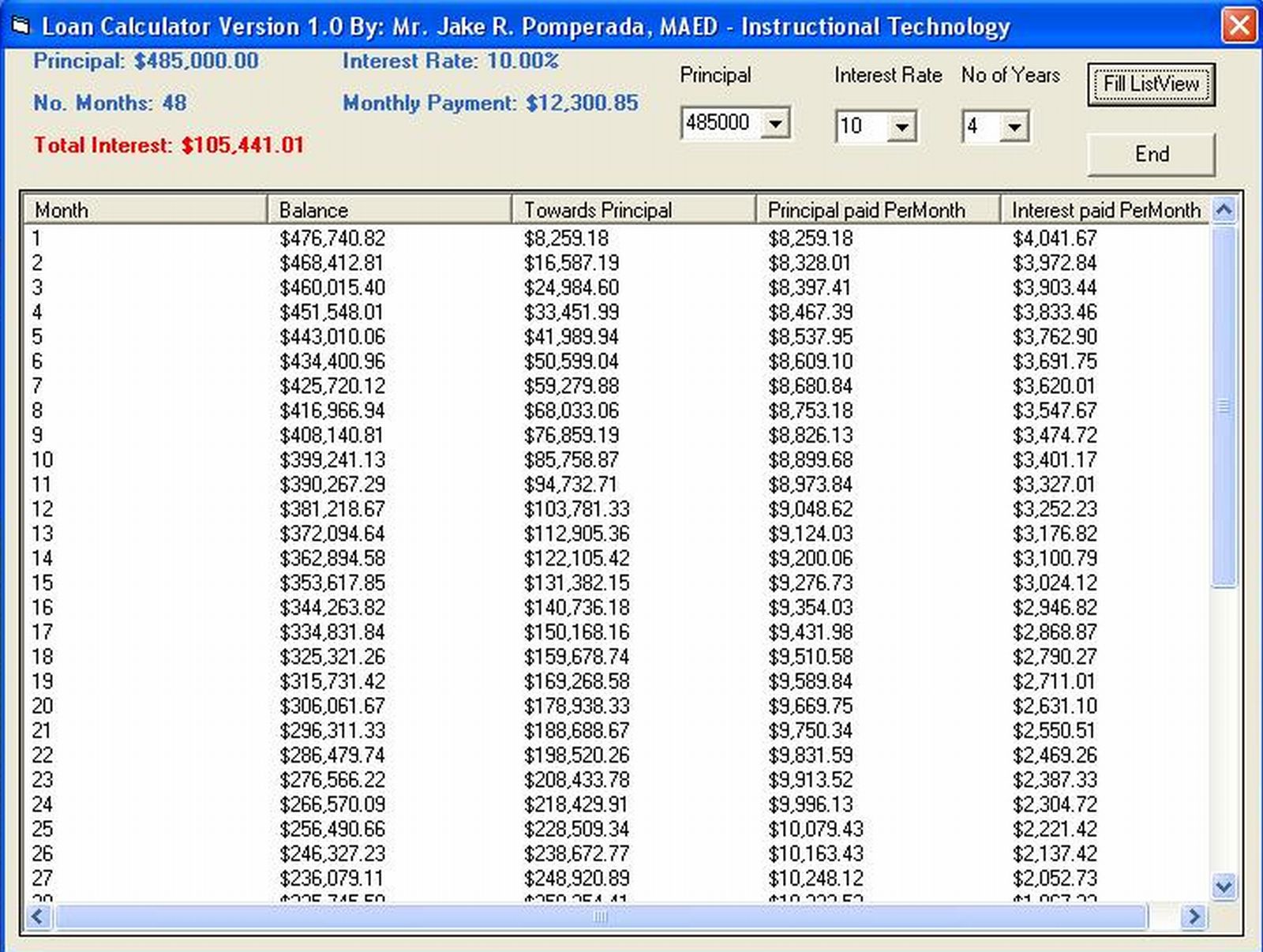

If your down payment is less than 20 percent of your home's purchase price, you will need to pay for mortgage insurance. Mortgage insurance protects your lender from losing money if you default on your loan. Typically, Federal Housing Administration (FHA) and US Department of Agriculture (USDA) loans require mortgage insurance. Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. Adjust the fields in the calculator below to see your mortgage amortization. If you want to accelerate the payoff process, you can make biweekly mortgage payments or put extra sums toward principal reduction each month or whenever you like.

Bond: Predetermined Lump Sum Paid at Loan Maturity

If your mortgage pre-approval is set to expire before you’ve completed the home-buying process, this does not mean you have to start the pre-approval application process from square one. Crunching the numbers and wondering how mortgage rates are determined? Read our guide to learn how they’re calculated, plus how to get the best rate possible.

California Mortgage Calculator - The Motley Fool

California Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Under such agreements, two parties exchange cash flows with each other. The lending bank will swap the variable payments it may make to service a mortgage (which is fixed to the SONIA rate) for payments at a fixed rate. This insulates the lending bank from unexpected increases in the SONIA rate. Mortgage rates change daily, but average rates have been moving between 6.5% and 7.5% since late last fall.

Bankrate

However, your exact rates may vary when you apply for a mortgage loan. If you don’t have an idea of what you’d qualify for, you can always put an estimated rate by using the current rate trends found on our site or on your lender’s mortgage page. Remember, your actual mortgage rate is based on a number of factors, including your credit score and debt-to-income ratio.

Ottolenghi said he had "always been super eager to get our flavours onto people's dinner plates nationwide, not just in London, without having to cook it from scratch every single time". The full range will be available in Waitrose shops, Waitrose.com and Ottolenghi.co.uk from today, while a selection of products will be available from the supermarket on Deliveroo and Uber Eats. It is the first time Ottolenghi has partnered with a supermarket in such a way. Nevertheless, the average policy was still 33%, or £157, higher between January and March compared to the same period last year. That was despite the average claim paid rising 8% to reach a record of £4,800, the body said. Aslef says train drivers have not had an increase in salary for five years, since their last pay deals expired in 2019.

And you can tweak things like the home price or loan terms to find the best mortgage options for your budget. And when you’re searching for a mortgage, the home price is the most easily adjustable factor. For example, you can’t negotiate on the property taxes in your state, but you can always try to negotiate a lower price on your home. PMI is calculated as a percentage of your original loan amount and can range from 0.3% to 1.5% depending on your down payment and credit score. Once you reach at least 20% equity, you can request to stop paying PMI. When you borrow money to buy a home, your lender requires you to have homeowners insurance.

Your down payment is subtracted from the total amount you borrow. When you own property, you are subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area. Most people choose 30-year fixed-rate loans, but if you’re planning on moving in a few years or flipping the house, an ARM can potentially offer you a lower initial rate. If you’ve been thinking about borrowing money and are curious to see what payments would look like before you apply, a loan calculator can be an ideal tool to help you figure this out.

If you choose, we’ll also show you estimated property taxes and homeowners insurance costs as part of your monthly payment. Our mortgage calculator can help you estimate your monthly mortgage payment. This calculator estimates how much you’ll pay for principal and interest.

Alabama Mortgage Calculator - The Motley Fool

Alabama Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

This influences which products we write about and where and how the product appears on a page. By 2001, the homeownership rate had reached a record level of 68.1%.

Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the Interest Calculator. For more information about or to do calculations involving APR, please visit the APR Calculator. The Federal Truth in Lending Act requires that every consumer loan agreement disclose the APR.

Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means.

No comments:

Post a Comment